Long Term Care Insurance costs vary depending on various factors such as health, age, where you live, and the benefits. If you choose wisely, LTC Insurance can be quite affordable. You need to find the middle-ground between what’s too much and what’s too little. Like any other form of insurance, you might buy Long Term Care coverage and never use it so it’s really important that you balance the equation.

Factors Affecting Costs for Long Term Care Insurance

- Age – it’s true that your age impacts the premium you actually pay, but watch stay keen on the ‘birthday close’ from some sales agents who try to rush you into the buying right away. It’s imperative that you take your time and shop wisely. Your age influences the cost by 3-5% each year. But that doesn’t mean you should rush to buy a plan that’s not necessarily right for you.

- Health – your current healthy plays a major role when it comes to determining your insurance coverage. Waiting for a couple of years to buy Long Term Care can seem like a plan. But who know whether you’re just one prescription away from an ailment, after which prices shoot up dramatically. In some cases, you might even end up being disqualified.

- Coverage Selected – some agents will try to tack in their favorite ‘riders’ to your plan, thus increasing the total cost of your premiums.

- Discounts Available – this is an obvious one, right? Nobody wants to miss out on a discount that decreases the cost of their LTC insurance. Some common discounts include preferred health, married and partner discounts.

The Clock is Ticking!

Costs rise as your age does.

So it’s probably time to think about how you can pay for your LTC Insurance coverage. Most people come up with innovative ways to bankroll their premiums in order to keep costs down:

- Use part of interest earned on any asset.

- Use of dividend income.

- Use of the interest earned on a variable or fixed annuity.

As goes the old adage ‘You get what you pay for’. This is true when it comes to Long Term Care insurance as well. Unless you have reason to think otherwise, low-rates from little-known carriers should be treated with suspicion.

Currently, there are more than 20 different firms selling Long Term Care Insurance in the nation. Only about half of these are A rated (or better) and have paid out more than $100 million in claims. Some few examples of reputable companies that you might want to work with are Genworth Financial, Mass Mutual, John Hancock, Transamerica, and United of Omaha.

Don’t Rush, But Know the Cost of Waiting

The majority of folks tend to think that they save money by waiting till they buy Long Term Care Insurance. It doesn’t work like this though. Put in mind the following factors that manifest each and every year that increase the cost of LTC Insurance.

- Due to inflation, the cost of healthcare rises each year. This means you have to buy more insurance.

- Premiums are calculated based on your age. This means that each year when you wait, costs go up!

- You healthy could change at the blink of an eye, putting you in a situation where you’re needed to pay higher premium. In some unfortunate, extreme cases, you might even be left uninsurable.

Example – Cost of Waiting

Let’s talk about John, a 50 year old American who purchases LTC from a leading carrier. The policy entails the following:

- Monthly benefit of $5000

- Benefit period: 4 years

- Elimination period: 3 months

- Compound inflation protection at 3%

His annual premium is $2,757.01. If he pays this annual premium till he’s age 85, he will have paid a total of $96,495.35 in premiums, and his benefits will have grown to more than $27,800 monthly.

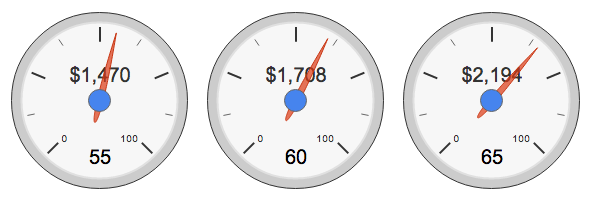

Compare John’s premiums if he waited for 5 years before getting started

If John waited 5 more years so that he started paying for LTC at the age of 55, his annual premiums would shoot up to $3,689.21. Considered that he paid his annual premiums till the age of 85, he’d have to parted with a total of $110,676.30 in premiums.

Now that John is 5 years older, the cost of health care increases. By waiting 5 years, John has to pay $14,181 in additional contributions through his lifetime. Not to forget, during this period of 5 years, John is also risking by being uninsured.

Can Insurance firms inflate the cost of premiums in the future?

This is a common question among people who are looking to buy Long Term Care Insurance. Well, the answer is a ‘Yes’. Insurance firms reserve the right to increase premiums for an entire class of policyholders. But they’d need this to be approved by a state’s insurance commissioner. When you work with a financially strong company, the chances of this happening are quite minimal.