Although it’s optional, inflation protection is probably the number one option you should have in your Long Term Care insurance policy. When you include inflation protection in your policy, your applicable benefit amount (daily or monthly) regularly increases to be at par with inflation and rising costs of Long Term Care.

Let’s assume you’ll need to use your Long Term Care coverage after about 10 years. If the cost of care in your area is currently $180 per day, it might have risen to $300 then. Inflation protection means that your benefit amount will rise at the same rate. For most policies, the amount of premium you pay won’t increase just because your applicable benefits have risen. If the insurance company wants to increase the premiums paid, they have to first ask for permission from your state’s insurance department.

Common LTC Insurance Protection Options

5% CIP (Compound Inflation Protection) applicable to those under the age of 75.

5% CIP (Compound Inflation Protection) applicable to those under the age of 75.- 3% CIP.

- 5% simple or Equal Inflation Protection for those aged above 75 years.

- CPI (Consumer Price Index)

- Future Purchase Option

What Option Should I Choose?

Your LTC insurance benefits adjust based on either simple or compound interest computation rates. At LTC Key, virtually all policies that we recommend have got the inflation protection options listed above. Let’s learn some more about each one of them.

a) 5% Simple or Equal LTC Insurance Protection for Inflation

For those who are over 75 years of age, this might be a suitable option. It means that your benefits will be increasing at a constant dollar amount yearly. For instance, if you’ve got the $100/day benefit, it increases with $5/day each year. That means that after 20 years, your daily benefit will have doubled to $200/day.

For those who are over 75 years of age, this might be a suitable option. It means that your benefits will be increasing at a constant dollar amount yearly. For instance, if you’ve got the $100/day benefit, it increases with $5/day each year. That means that after 20 years, your daily benefit will have doubled to $200/day.

b) 5% CIP (Compound Inflation Protection) for Long Term Care

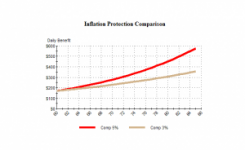

This is meant for policyholders under the age of 75. 5% compound inflation protection means that your benefits grow by a bigger dollar amount each year compared to the 5% simple inflation protection. Let’s say, for instance, that you have a $100/day benefit. This will have compounded to $265 daily after 20 years. That’s how compound inflation protection could make a significant benefit in your applicable benefit over many years. If you suspect that you have a life expectancy of beyond 15 years from now, we advise that you go for the 5% compound protection. Otherwise, you might just do well with the 5% simple option which is less expensive.

c) Future Purchase Option

This is inflation protection that’s offered by your LTC insurance firm after every 3 years as an addition to existing policies. This option is usually usual with Group LTC insurance plans. Individually, this can be a very bad for you, more so if you are younger. Turning down this option can be even trickier in that it won’t be offered again, which means you pay more and get stuck at the same lower-level of benefits/coverage for years.

d) 3% CIP (Compound Inflation Protection)

You may find a reasonable balance between price and benefits increase in this option. This is a quite cheaper rider compared to the 5% compound inflation protection, but the disparity between the two over a course of let’s say 25+ years can be significant. We recommend that you go for this option only if you’re purchasing LTC coverage in your 60’s.

e) Consumer Price Index (CPI)

Another type of protection offered by some carriers over the last few years is Consumer Price Index (CPI). This increases your LTC insurance benefits amount at the current CPI Index. Checking with multiple government agencies, this appears to average at about 3%. It might sound like a logical option, but the risk is that medical expenses often rise quicker than inflation, meaning you get little genuine protection.

Another type of protection offered by some carriers over the last few years is Consumer Price Index (CPI). This increases your LTC insurance benefits amount at the current CPI Index. Checking with multiple government agencies, this appears to average at about 3%. It might sound like a logical option, but the risk is that medical expenses often rise quicker than inflation, meaning you get little genuine protection.

Inflation Protection is no doubt the most vital feature to include in your policy, more so if you’re aged 70 or less, or have longevity running in the family.

Inflation and Long Term Care

Sometimes back, California’s Department of Insurance kick started a study on LTC costs. It was established that over 30 years, the actual inflation increase for long-term care services stood at 5%. This came as a surprise to many agents, more so those who were recommending the 3% and CPI inflation protections to their clientele.

One of our clients aged 58 (his wife was 59 at the time) was planning to buy a policy with the 3% compound protection. We didn’t give this a pass. Why? Because we assume that this client will need to use their care after the next 25-30 years. Going by California’s current standards, the cost of care is $150/day on average. But by using the state’s findings of 5% price increase rate, we realize that the client would need to consume $520/day in care costs after 25 years. That’s why we’d not recommend anything else than 5% compound inflation protection for this client.

To get side-by-side comparative quotes from top insurance providers in the nation, simply complete our form below.\